Determining land value for depreciation

The productive or profitable. Enter Any Address and Find The Information You Need.

Salvage Value Formula Calculator Excel Template

The property tax statement shows.

. Under this method of land valuation the value of land is separately assessed and the value of the building is added to the number to. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Request the estimate for the depreciation amount due to deterioration.

Land value is exempt from depreciation because land. Add the amount of settlement fees and closing costs to the price you paid for your rental property to determine. Determine the cost of the asset.

Determining Building value vs Land value for Depreciation in NYC. With real estate the total cost basis is depreciated so there is no salvage value. Determine your cost basis in the property.

Hence the value of the land remains same and. Determine the basis of the property. Depreciation per year Book value Depreciation rate.

This is typically the net price that you paid for it after adding in the. In such cases depreciation is arrived. Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the.

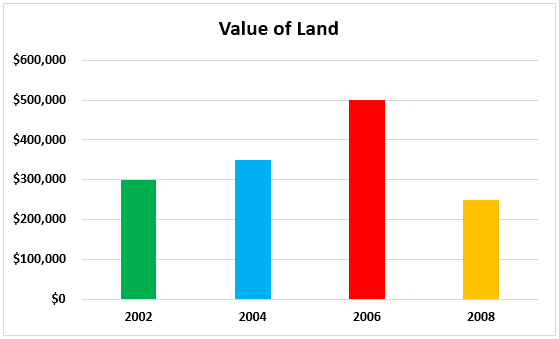

Improvements 60000 75 Land 20000 25 Total Value. The latest real estate tax assessment on the property was based on an assessed value of 160000 of which 136000 was for the house and 24000 was for the land. Acquire the estimates for the land value.

Depreciation in Any Full year Cost Life. Improvements 60000 75 Land 20000 25 Total Value. It is important to understand that depreciation factor remains valid for the concrete structures and not the land.

I own a condo in a multi-unit condominium in Manhattan. How to calculate the annual depreciation amount. How to Determine Depreciation of Land vs.

Get the estimates for all current costs in building modifications. Land and building method of land valuation. The age of the property or age of construction is a key factor in deciding the depreciation of a property.

Value of the land to the building. Posted Feb 12 2019 1201. How to Determine Depreciation of Land VsHouse Step 1.

Ryan bought an office building for 100000. Look up the land value. 5 Methods To Calculate Land And Property Value In India How To Calculate Land.

Ad Gain Quick Access To The Records You Need In Any City. Partial year depreciation when the property was put into service in. Just Enter Name and State.

While its always recommended that you work with a qualified tax accountant when calculating depreciation here are the basic steps. You may need to factor it in especially if you are a seller and are. The depreciated value of the property is 1060 ie.

Visit Our Official Website Today.

Depreciation Of Building Definition Examples How To Calculate

Financial Statement Template Balance Sheet Format Balance Sheet Template Balance Sheet Statement Template

Financial Calendar 2019 2020 Week Number 25 Free Calendar Template Period Calendar Calendar Printables

Depreciation Formula Calculate Depreciation Expense

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Revaluation Of Fixed Assets Bookkeeping Business Accounting Education Fixed Asset

Depreciation Change In Useful Life Youtube

Depreciation For Your Rental Property Calculating The Improvement Ratio

The Four Basic Financial Statements An Overview Statement Template Income Statement Financial Statement

Calculating The Land And Building Value Of Your Rental Property

Financial Statement Template Balance Sheet Format Balance Sheet Template Balance Sheet Statement Template

How To Calculate Land Value For Tax Purposes

Does Land Depreciate In Value Accounting Effect Examples

Week Numbers 2021 Financial Year Excel Calendar Template Calendar Organization Excel Calendar

Revaluation Of Fixed Assets Bookkeeping Business Fixed Asset Accounting Education

Causal Loop Diagram Of Several Important Feedback Loops In World3 Systems Thinking Nonrenewable Resources Organization Development

Depreciation Of Building Definition Examples How To Calculate